Kiko Martinez

May 19, 2021

Workshop Explores New Legislation to Expect in 2021 and Beyond

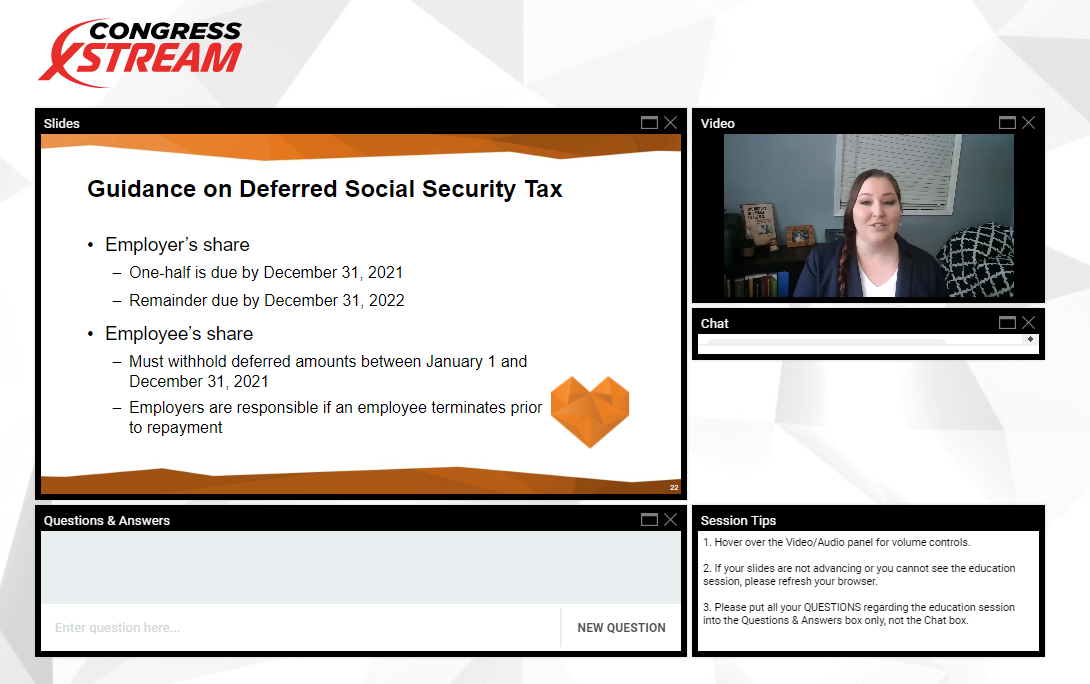

In their workshop session “Payroll Developments: What to Expect in 2021 and Beyond,” two APA experts discussed the latest COVID-19 relief measures, new legislative and regulatory initiatives, and how payroll professionals can be prepared for what lies ahead.

In their workshop session “Payroll Developments: What to Expect in 2021 and Beyond,” two APA experts discussed the latest COVID-19 relief measures, new legislative and regulatory initiatives, and how payroll professionals can be prepared for what lies ahead.

Laurel Serra, CPP, Director of Payroll Training for the APA, and Curtis Tatum, Esq., In-House Counsel and Director of Federal Payroll Compliance for the APA, led the timely session.

Payroll pros had their work cut out for them last year. With a new administration and congressional session in 2021, which led to new compliance requirements, it’s bound to continue to get busy as the year continues. This is especially true this year, Tatum said, since everyone is still dealing with the pandemic.

“The good news is that a lot of the changes for 2021 build on COVID-19 relief measures that started in 2020,” Tatum said. “Hopefully, this means that payroll pros are already familiar with the basic compliance requirements. The DOL and IRS have worked hard to release guidance to help employers understand all the new requirements. Of course, I would recommend reading Payroll Currently each month [APA’s compliance newsletter free to APA members] and subscribing to APA’s Pay News Now (website news articles), so that you have the latest compliance information sent right to your inbox.”

Tatum hopes workshop attendees will have a better understanding of new federal payroll compliance issues and have some insight into what might be in store in the future, specifically at the IRS and DOL. He and Serra also advised them to watch a potential increase in the number of FUTA credit reduction states in 2022.

“We looked at some of the actions already taken by the Biden administration and the goals for future actions that could have payroll implications,” he said. “We were able to provide a high overview of COVID-19 relief measures with a focus on the changes made by the American Rescue Plan Act of 2021.”

Attendees had some questions during the virtual workshop. A few used the comments section to their advantage to ask them during the session. This included questions like "Are employers required to offer the COBRA subsidy or is it optional?" and "Is pay data required on EEOC federal reporting?"

"Awesome presentation," said Lauran Gularte, CPP, Payroll Manager at the Alaska Native Tribal Health Consortium. "I will watch this again."

Julie Keeth, CPP, Payroll Specialist at the San Jacinto River Authority added: "Thank you all for the work you have put into the presentation."