Kiko Martinez

May 20, 2021

Updates, Issues, Your Questions Answered on California Payroll

California payrolls are always a challenge, and 2021 is no exception.

California payrolls are always a challenge, and 2021 is no exception.

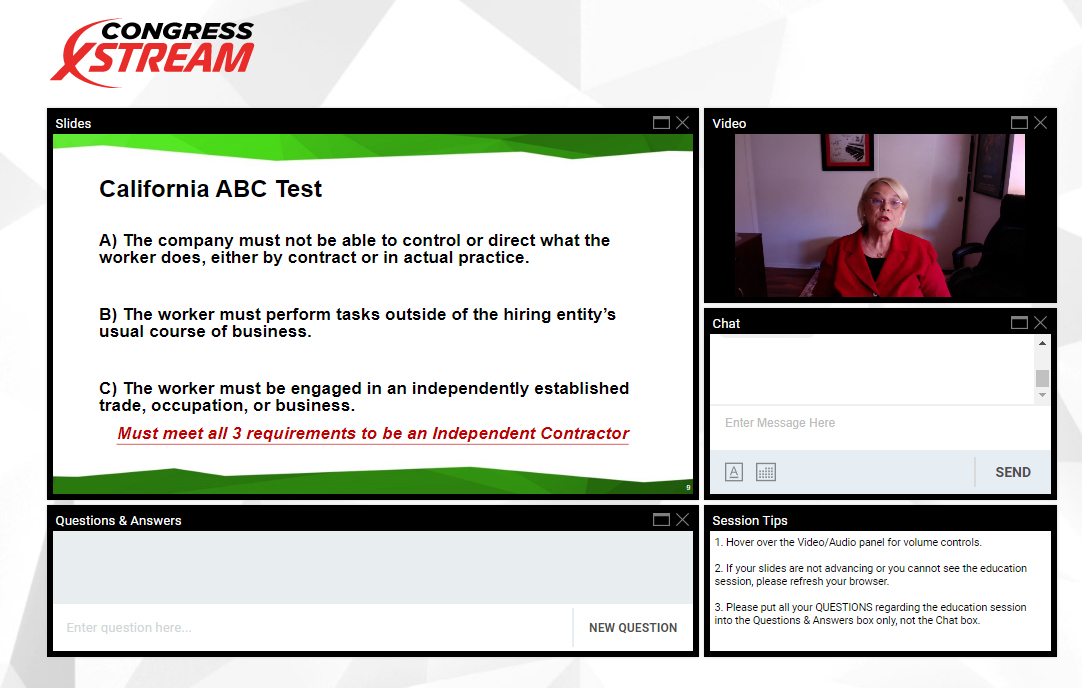

Sondra Dougherty, CPP, owner of Employer Compliance Services and an APA Past President, and Rebecca Harshberger, CPP, Vice President of Payroll Tax at Entertainment Partners, discussed the latest updates on legislation and labor law regulations covering California employees during the workshop “California Payroll: Addressing Updates, Issues, and Your Questions.”

Some of the topics Dougherty and Harshberger talked about included the expansion of the California Family Rights Act, new California pay data reporting requirements, and new notice requirements.

“The California Legislature is in session year-round, and that provides for much activity in keeping up with new laws and regulations that affect payroll and human resources,” Dougherty said. “Also, California has many local ordinances that affect employee pay and benefits. COVID-19 statutes and ordinances on a state and local level are especially challenging to keep up with and will continue to affect the workplace as we see more companies bringing employees back to the workplace.”

She says staying alert on new and expiring payroll regulations will be a first step for payroll professionals in California to be prepared for the rest of 2021.

“California state agencies such as the Employment Development Department have been doing a good job providing material and websites for resources to keep up with legislative changes,” she said. “APA’s publication PayState Update is a must to stay on top of new state and local payroll regulations. You will notice almost every issue has payroll updates for California.”

Harshberger said California labor and employment laws are ever-changing and complicated. She hoped attendees could focus on two takeaways from the session:

- Audit your timekeeping system to ensure the system is not rounding when an employee enters their break time after five hours—at both the beginning and end of the break.

- If you require an employee to “check out” (for a bag search) before leaving work, ensure that your policy is to have them clock out after the search, not before.

As the year continues, Harshberger said there are ways to stay ahead of all the changes that California is contemplating.

“The good news is that all new California legislation had to have been introduced by February 19, so of the three areas (laws, court decisions, and ballot initiatives) you need to track, one is now easier,” she said. “Even better, California does a great job of keeping the information current on their websites, which makes it less painful to track employment-related changes, check the sites monthly for updates, or sign up for updates.”

Californians may be close to the beach, but all the payroll professionals at Congress Xstream weren't taking a break on Thursday. They were all listening in closely to the workshop, interacting with one another in the comments section and talking about the highs and lows of payroll in California.

"Paydata reporting from California was the worst this year," said Dee Hagerty, CPP, Senior Principal Product Manager at Oracle. "They didn't release requirements until February for filing in March. Not enough time for software vendors."

Others like Veronica Hernandez, CPP, Payroll and AP Administrator at Imperial Irrigation District, said she faced more challenges than just pay data.

"Our challenge was combining/tracking SB95 and ARPA," she said.

Jen Warren, Payroll Compliance Manager at Dudek, said she joined the workshop because her company is based out of California.

"California is special," she said. "The paydata reporting was helpful. I looked into that immediately. I am pretty privy on payroll laws and regulations on California . It is nice to be able to connect with other California payroll pros for sure and just talking about California regulations is helpful."