Kerry Cole

June 5, 2020

Experts Discuss Mandated Paid Sick Leave

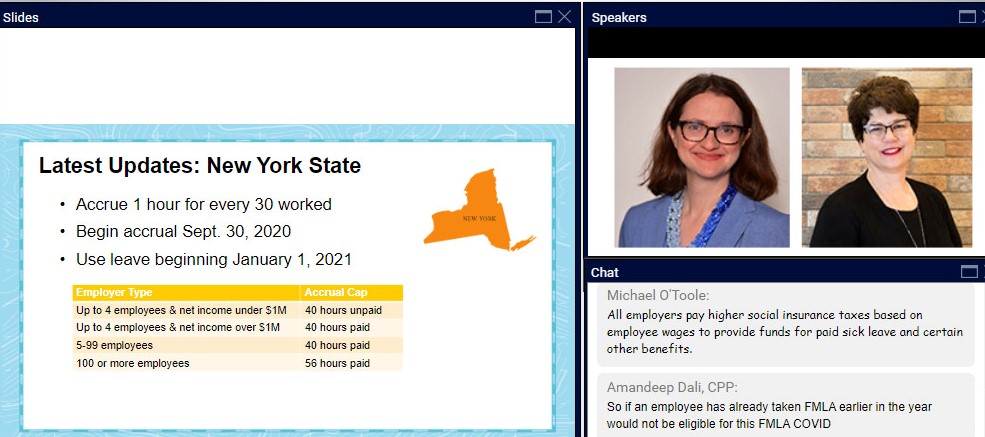

With emergency COVID-19-related leave instituted nationwide, state and local legislation of paid sick leave is gaining traction across the country.

In the Thursday, June 4, Congress Xstream workshop Paid Sick Leave: From Perk to Mandate, two industry experts discussed key obligations of the COVID mandates in effect throughout 2020 and how they compare to existing laws.

Beth Baerman, Director of Communications and Compliance for Attendance on Demand, and Lia Coniglio, Esq., Manager of State Payroll Information Resources for the APA, also discussed leave accrual, caps, and pay rate calculations.

“We’re not giving legal advice today, but hopefully what we’re doing is giving you everything you need to place questions in your mind so that you can have an informed, efficient conversation to achieve compliance for your organization,” Baerman said in introducing the topic.

She noted that 94% of managers have paid sick leave, compared with 58% of service workers. Conversely, only 47% of low-wage workers have it, while less than 20% of food service workers do. Without paid sick leave, she said, workers are 1.5 times more likely to report to work sick and three times more likely to forego medical care.

The COVID-19 pandemic highlighted the need for paid leave, she said, especially for frontline workers with no access to paid sick leave and for parents who have child-care concerns with schools closed.

Coniglio introduced her segment on paid sick leave during the pandemic by saying, “Wouldn’t it be great if the law just said, ‘You just pay them their wages, and that’s it.’ Unfortunately, it’s a little more complicated than that. The compensation rate is dependent on the reason for leave.”

She explained that the Families First Coronavirus Response Act is for employers with less than 500 full- and part-time employees and includes a small-business exemption.

The existing Family and Medical Leave Act has been modified only for the COVID-19 event, Coniglio said.

While some attendees commented in the chat that they are relieved to have software that automates calculations related to COVID-19, Danielle Ramos, CPP, offered some cautionary advice: "Review those automated set-ups; don’t assume the system is doing it correctly."

Coviglio recommended these APA resources on the topic:

- APA's Guide to State Payroll Laws

- Table 9.2 – State/City Paid Sick Leave Requirements

- PayState Update e-newsletter

- Payroll Source Plus

- Subscribe to APA News to receive Pay News Now digests electronically

State and local changes to paid sick leave will also be covered in “Payroll Issues for Multi-State Employers – Special Edition Covering COVID-19” through an interactive virtual classroom on July 27, 29, and 31.

Although attendees appreciated the wealth of information presented, Brent Gow, CPP, quipped, "There is so much info in this session that it is making me 'sick'."